April 2, 2024

Open Letter to the Community regarding The City of Black Hawk’s Lodging Tax Increase and Conditional Offer to Support the Gilpin County Parks and Recreation Department with $1,000,000 in 2025, with annual adjustments thereafter and Gilpin County’s interest to start negotiations.

The offer was not declined.

The City of Black Hawk would like to raise taxes, within their city, on hotel stays in the form of increasing their Lodging Tax. Those guests staying at the hotels within the City of Black Hawk would be paying this new increased tax. That tax is subject to City of Black Hawk voter approval. As proposed, up to $1,000,000 of the proceeds from this tax increase would be remitted to Gilpin County in monthly payments in 2025. Those funds would be restricted to support the Parks and Recreation Department operations and would be indexed for inflation every year thereafter, subject to TEN conditions imposed by the City of Black Hawk onto Gilpin County, in order for the County to receive and continue to receive the payments generated from the new tax in the City of Black Hawk.

It is important to confirm that the County was not consulted, only one commissioner, prior to receiving the offer and conditions, and that the offer was shared as non-negotiable, with the exception of the 84-hour requirement, which could be modified, provided the Parks and Recreation Department remains open 7-days a week. Following the March 26, 2024 Executive Session, the Gilpin County Board of County Commissioners shared publicly that an offer was received and that they expressed an interest in negotiation. The Board felt that a number of the conditions required further discussion and consultation while others were outside of their control. This exchange was conducted in the eye of the public, because representatives from the City of Black Hawk expressed their intent to share publicly their offer, if it was not accepted outright. Based on that understanding, the County felt it was best to be as transparent as possible with the public to share the points discussed, from both sides outright. Typically, these types of negotiations are conducted privately, usually involving the whole Board or duly appointed representatives, and later shared once common ground is found, though in this situation the offer and messaging were not presented that way.

Though many of the TEN conditions were found to be acceptable (Conditions 6, 8 & 9), some of them were not for a number of reasons. A more robust summary of a few of those conditions where adjustments are requested can be found below:

[CONDITION NO. 10]

The Gilpin County Community Center is open seven days a week for a minimum of 84 hours.

Due to the loss of a dedicated revenue source with the failure of ballot measure 1A in November 2023, the Community Center was reduced to being open to the public 4 days per week for 42.5 hours. The revenue received in 2023 (the final year) from the dedicated Parks and Recreation Mill Levy was $1,153,707. Of the total funds received for this temporary tax measure, $674,582 of which were not spent in previous years. These carry-over funds were used to sustain the Parks & Recreation Department in 2024, given the loss of revenue. These funds were not previously spent due to wise use of limited funds and to potentially lessen the impacts if future funding was not secured, which is indeed the case in 2024. The one-time funds of $674,582 are currently being used to support operations in 2024, with the reduction in operation to four days and fewer hours in 2024. The carryover funds will be drained, with no carryover remaining in 2025 which means that the $1,000,000 offer from Black Hawk for 2025 will only provide $321,105 more dedicated funds than what we have for 2024. The Parks and Recreation Department is currently open 42.5 hours, so the additional $321,105 would need to be stretched if the hours of operation are extended to essentially double the existing hours of operation. That amount would need to cover all of those expanded operational costs (utilities, staffing, equipment, maintenance, etc.) in order to keep the center open. A basic summary of this is demonstrated in the table below where at least an additional $531,219 would be needed to support a 7-day operation, so suggested. For historical context the Community Center has never been open more than 76 hours per week.

Parks and Recreation Department | 2024 (budgeted) | 2025 (open 7 Days – estimated) |

| Revenue | $466,064 | $524,800 |

| Carryover (one-time) | $674,582 | $0 |

| Black Hawk Tax | N/A | $1,000,000 |

| Total Revenue | $1,140,646 | $1,524,800 |

| (difference) | $384,154 | |

| Expenditure | ||

| Capital | $1,026,330 | $1,026,330 * estimated |

| Salaries | $678,885 | $1,130,169 |

| Utilities | $223,600 | $250,000 |

| All Other (see budget for full details) | $780,186 | $833,721 |

| Total Expenses | $2,709,001 | $3,240,220 |

| (difference) | ($531,219) |

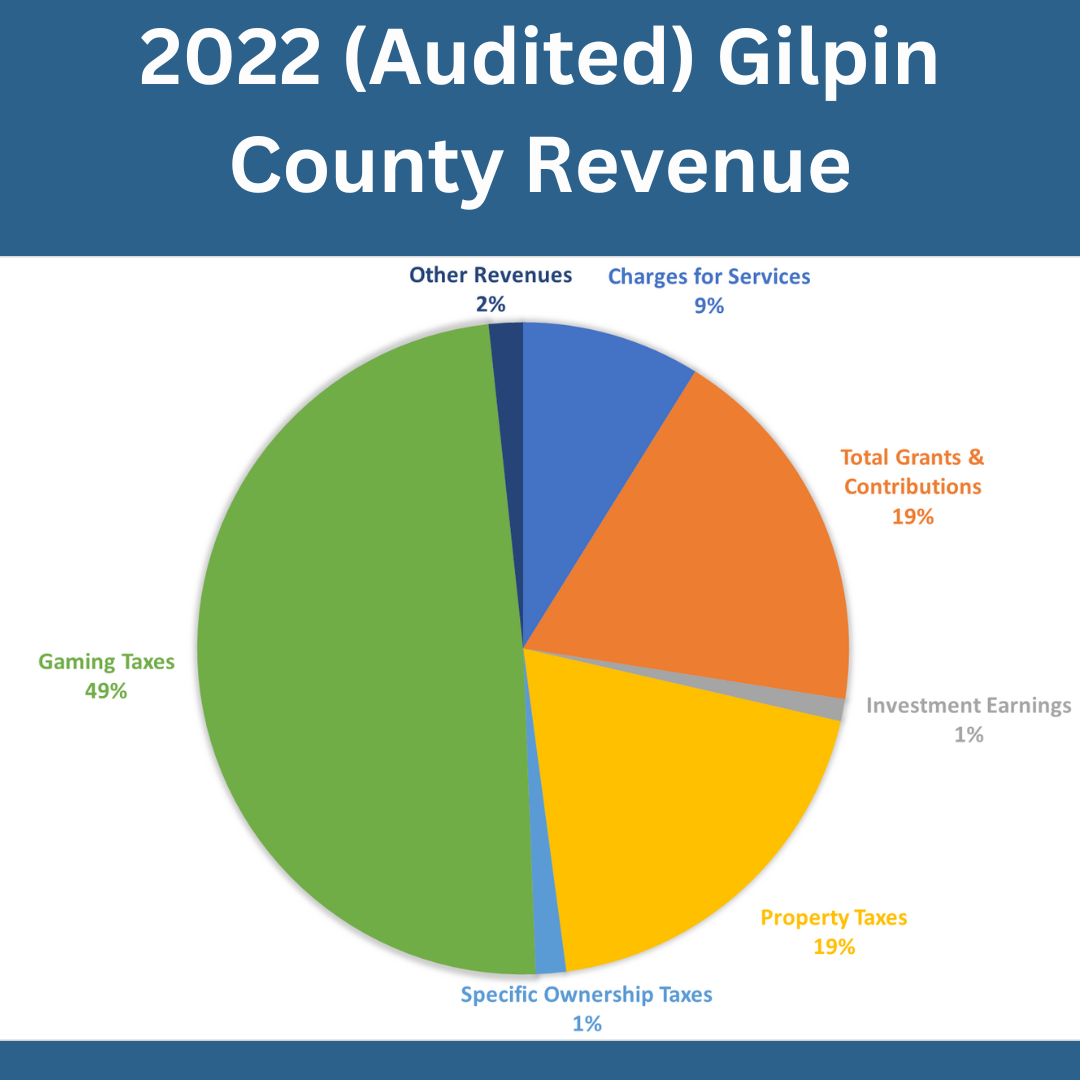

According to the proposed agreement, the County will pay the additional cost of keeping the Community Center open 7 days. So, in accepting the $1,000,000 it will cost the County $531,219 or more. As shared widely in February 2024, Gilpin County has the lowest property tax of counties with no sales tax, and effectively has the lowest combined tax rate (sales and property tax) in Colorado. This means that without our annual gaming distribution, Gilpin County and its estimated $5,147,392 (after the TABOR credit) in property tax received in 2024, the vast majority of which are paid by casinos, would not be able to provide basic levels of state and federally mandated services. The next logical case for funding the difference would be from our gaming distribution received from the State of Colorado, which originates from gaming activity generated from the casinos located inside Black Hawk and Central City (not from the municipalities directly).

If you exclude the year of 2020 and the impacts the Covid-19 pandemic and very recent possible cyclical increases on our gaming distribution, the typical Gilpin County distribution was fairly flat around $10.5 Million over the past 10 plus years. For context, the $16,102,591 consolidated gaming distribution received by Gilpin County in 2023, which was the highest on record, was not enough to cover both the Sheriff’s Office operations ($12,943,060) and Public Works Department ($4,775,303) for a total of $17,718,363 or a -$1,615,772 difference. This reality leaves the remaining departments; Assessor, Attorney, Clerk & Recorder, Elections, Commissioners, Coroner, CSU Extension, Community Development, County Manager, Parks and Recreation, District Attorney, Facilities, Finance, Human Resources, Human Services, Veteran Services, Information Technology, Surveyor, Solid Waste, Public Health, Treasurer and Public Trustee, and their necessary services to be funded through taxes and fees.

The Board is unable to make a commitment for expanded hours when there are so many statutory and critical services provided by the County which should, and are, required to take priority over elective operations and services, such as those offered through the Parks and Recreation Department. If gaming funds were to decrease, the Board and the County would be faced with the demands of funding critical departments required by state statutes such as the Sheriff’s Office and/or Public Works Department while at the same time hamstrung with the IGA terms ensuring Parks & Recreation remain open to the extent prescribed, with only a third of the cost covered by this new Black Hawk tax. The long-term effects of such an arrangement will have a strong negative impact on the public health and welfare of Gilpin County.

Breaking the agreement in order to raise taxes to fund essential services would put the County in the position of having to lay off significant numbers of staff, including the new staff hired for the Community Center, losing the monthly installment payments from the City of Black Hawk, while waiting until November and January for a tax increase to potentially pass and the tax to go into effect. The County does not want to enter into an agreement that it may later need to break.

[CONDITION NO. 1]

The total Gilpin County mill levy, including the mill levy for the Gilpin County Library District, shall not exceed 10.695 mills.

Gilpin County is both unable and unwilling to commit to a perpetual restriction to any future adjustment in the mill levy and the will of the voters of Gilpin County in this manner. If additional funds are pursued, it would be for the purpose of ensuring adequate revenue to protect the public health and welfare of the public. Such a restriction would have negative long-term effects on public safety and services since those remaining departments/services have limited dedicated funding to support their operations. The County is already mandated to return a portion of property tax back to the taxpayers, in the form of a 1.253 mill levy temporary tax credit which amounted to a $685,188 reduction in property tax revenues this year, which again primarily was returned back to casinos.

In addition, the Gilpin County Library District (“Library”) and their mill is not controlled by the Gilpin County Board of County Commissioners per our IGA with the Library which was approved in December of 2021. A separate Board of Trustees operates and oversees a separate budget. It is included as part of the annual Gilpin budget, but it is separate. In addition, the ballot measure approved by the voters of Gilpin permits annual adjustments to the mill based on inflation. The Board is unwilling to enter into an agreement where action outside of their control may negatively impact broader critical public services.

The county has no powers to restrict Special District mill levies and taxation. Those are separately voter approved and overseen by boards of directors.

View the 2023 Abstract of Assessment to view all the various mill levies currently collected throughout Gilpin County.

[CONDITION NO. 3]

No Gilpin County Sales Tax, Use Tax, Lodging Tax, or any other tax or fee shall be imposed within Black Hawk.

The County is unable to charge a lodging tax within either municipal boundary, per state law. The voters of Gilpin County already approved a Lodging Tax in 2022 for all areas of unincorporated Gilpin County, despite a provision prohibiting such an action as part of the IGA between the City of Black Hawk and Gilpin County School District RE-1. Black Hawk has its own lodging tax in addition to sales and use tax.

There has been no discussion by the Board of County Commissioners of referring a sales, use, or any other tax or mill levy to the voters.

[CONDITION NO. 7]

No part of the territory in Gilpin County shall be included within the boundaries of the regional transportation district or any other governmental or quasi-governmental entity created to finance transportation or mass transit.

The Board of County Commissioners believe a connected public transportation service is needed for the County so as to lessen our demand on privately owned vehicles. Such a service could provide transportation to/from home, work and other locations more affordably for the public, while providing an environmentally friendly option. Such a blanket prohibition across Gilpin County could negatively impact such an effort throughout the County; though the Board is receptive to tailoring any such effort to exclude taxing Black Hawk’s casinos.

The Board of County Commissioners appreciates the City of Black Hawk’s interest in finding a secure funding source to support the important services provided through the Parks and Recreation Department and continues to look forward to future discussions.