County Budget 101

Understanding how Gilpin County’s budget works is important for everyone who lives, works, or visits here. The County provides a wide range of services—from roads and public safety to public health and human services—and all of it depends on how we collect and allocate revenue.

To make the budget more transparent and accessible, we’ve created County Budget 101: a series of short explainers that break down where County dollars come from and how they are used. Each post highlights a major source of revenue or expense, showing both its importance and its challenges.

This is a work in progress and new articles will be added approximately weekly. Please note: all the numbers and percentages are based on 2024 actuals.

👉 Explore the articles below to see how Gilpin County is funded and how those dollars support your community.

The 2026 Draft Budget was presented at the September 23, 2025 Board of County Commissioners meeting. View the 2026 draft budget presentation.

Special budget work sessions are scheduled to review portions of the budget as follows:

- October 7, 9 a.m. to 4 p.m., HHS building, 15193 Highway 119, Black Hawk

- October 9, 11 a.m.

- October 15, 9 a.m.

- October 16, 9 a.m.

- October 22, 9 a.m.

These will be held at the Historic Courthouse at 203 Eureka Street, Central City unless otherwise noted here or on the Commissioner Meeting page.

Members of the public are invited to view the full draft budget in person at the Old Courthouse, 203 Eureka Street, 2nd floor. You can also view the 2026 draft budget online.

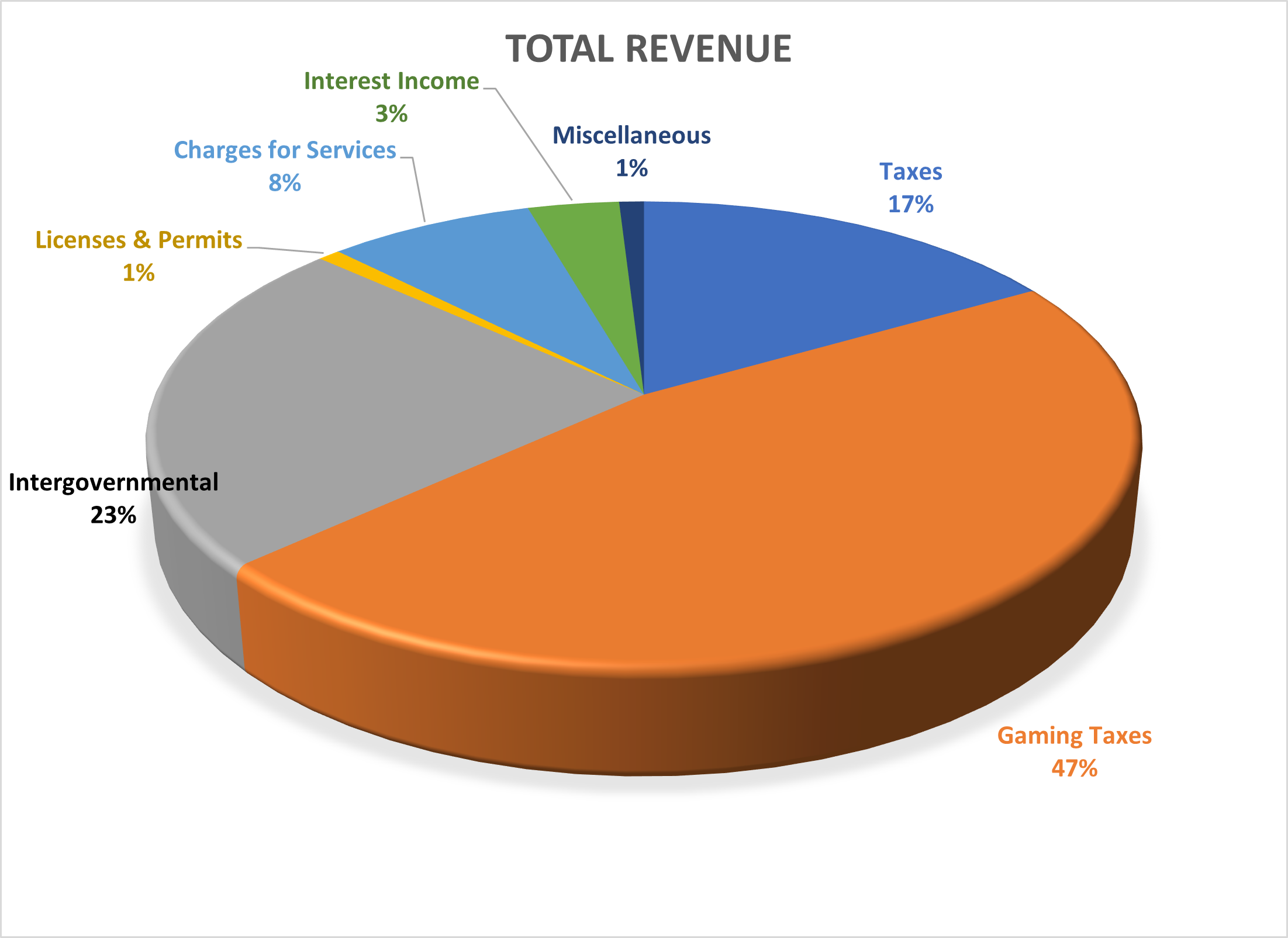

Revenue: Where the Money Comes From

Gilpin County relies on a mix of revenue sources. These articles explain each piece of the pie, what it funds, and the challenges that come with it.

- Property & Lodging Taxes (≈17%)

- Gaming Revenue (≈47%)

- State & Federal Funds (Intergovernmental) (≈23%)

- Other Revenues (Fees, Licenses, etc.) (≈13%)

Expenses: Where the Money Goes

Revenue tells only half the story. This section explains how those dollars are spent across services and departments.

- Public Safety (Sheriff, Jail, Dispatch, etc.) - future article

- Public Works (Road & Bridge, Infrastructure) - future article

- Human Services & Public Health - future article

- Parks, Recreation, and Community Facilities - future article

- General Government & Administration - future article

Revenue

Property Tax Breakdown

Property taxes combined make up just 17% of total County revenue—and residential property taxes are only a small portion of that total.

Here’s where property taxes are actually collected from in Gilpin County, based on 2024 Assessed Values (County mills only, not including special and educational districts or temporary tax credits):

- Vacant Land: 8.20%

- Residential: 21.19%

- Commercial: 67.07%

- Industrial: 0.03%

- Agricultural: 0.07%

- Natural Resources: 3.44%

Understanding these numbers helps put the County budget in perspective: property taxes are only one piece of the funding puzzle.

Gaming Revenue

How Colorado’s Limited Gaming Fund Works

- Collection of Revenue

All revenue from Colorado’s limited gaming—gambling tax revenues, license and application fees, and related payments—goes into the Limited Gaming Fund. Before any distribution, administrative costs for the Gaming Division and two months’ operating expenses are covered. - Distribution Formula

After expenses are paid, the remaining funds are distributed according to the constitutional and statutory formula:- 50% to the state share (General Fund and other designated state cash funds)

- 28% to the Colorado State Historical Fund

- 20% of that (i.e., 5.6% of total) goes to Black Hawk, Central City, and Cripple Creek, based on revenue generated

- 80% goes to historic preservation statewide

- 12% to Gilpin and Teller Counties, in proportion to gaming revenue generated in each

- 10% to the cities of Black Hawk, Central City, and Cripple Creek, again in proportion to local gaming revenues

- The “Extended” Gaming Fund—Amendments 50 & 77

Separate from the Limited Gaming Fund, there's an Extended Limited Gaming Fund tied to expanded gaming authorized by state constitutional Amendments 50 (2008) and 77 (2020):

Its distribution is:- 78% to community, junior, and local district colleges for financial aid and instruction (allocated by enrollment)

- 12% to Gilpin and Teller Counties, proportionate to tax revenues in each county

- 10% to central gaming cities, again based on revenue share in each city

Gilpin County’s Share—How It’s Calculated

Gilpin County receives two distinct revenue streams:

- From the Original Limited Gaming Fund (12%)

Gilpin’s portion is based solely on the share of gaming revenue generated in Gilpin County relative to Teller County.- For example: if Gilpin produces 70% of the combined gaming revenue from both counties, Gilpin gets 70% of that 12%.

- From the Extended Limited Gaming Fund (12%)

Similar proportional methodology applies here: Gilpin’s share reflects its portion of the extended gaming tax revenue compared to Teller.

These two mechanisms ensure Gilpin County is compensated in line with its gaming activity.

Why It Matters

Funds help offset the infrastructural and social impacts of gaming on local communities and also support educational and historical initiatives statewide.

Gaming revenue is by far the County’s single largest source of income, accounting for close to half of all annual revenue (about 47%). While essential for funding services and infrastructure, this revenue is also volatile—subject to change based on broader economic conditions and visitor activity.

In addition to gaming taxes, Gilpin also collects property taxes from casino properties, which provide another important source of local revenue.

Summary

Colorado’s gaming revenue model ensures counties like Gilpin receive funds in proportion to their role in the industry. For Gilpin, gaming revenue—along with casino property taxes—makes up a critical part of the County’s budget, sustaining services while also presenting challenges due to its year-to-year unpredictability.

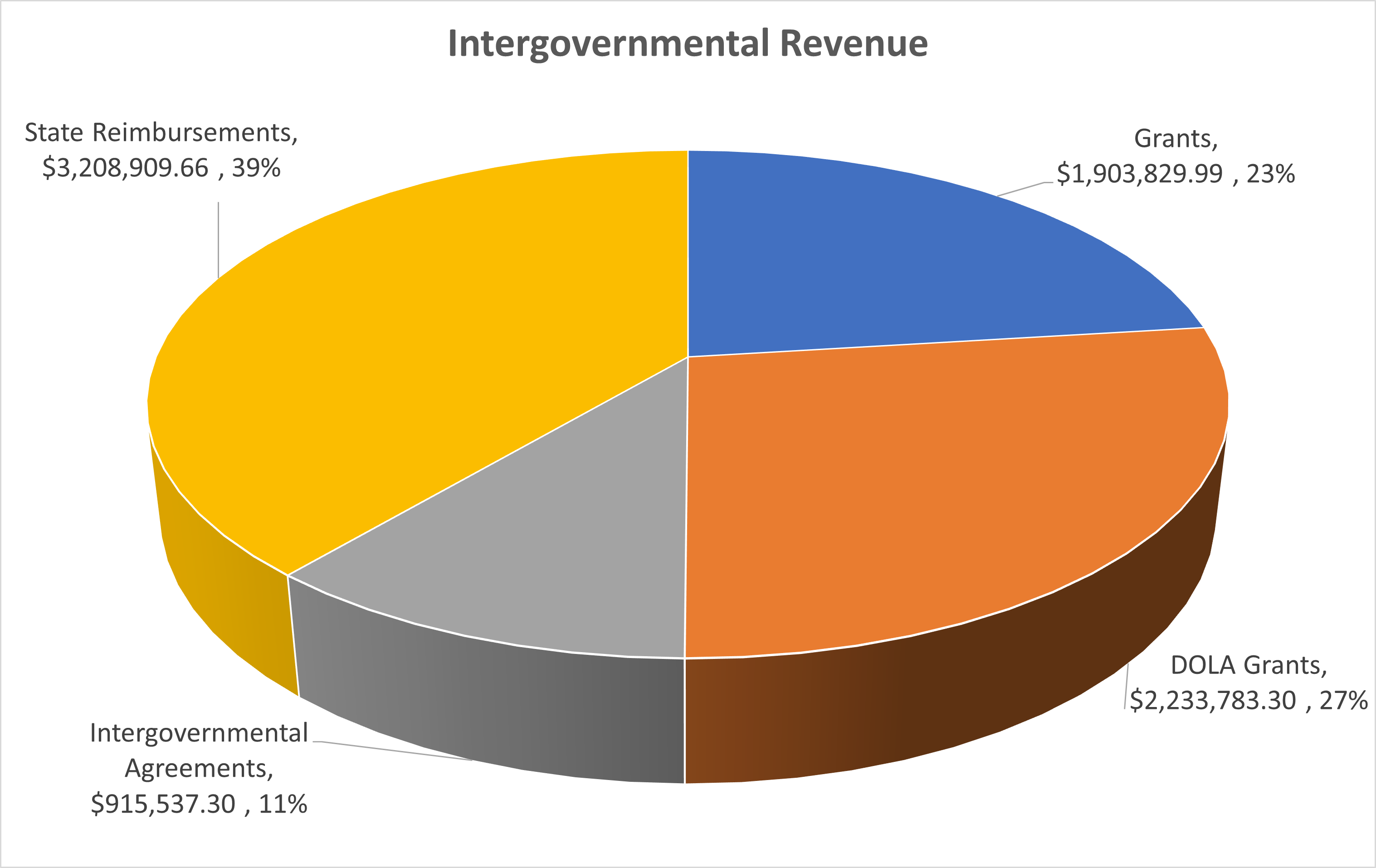

Intergovernmental Funds

The second largest share of Gilpin County’s budget comes from intergovernmental funds — about 23% of total revenue.

These dollars often arrive as grants, reimbursements, or public sector partnership agreements for specific programs like Human Services, Public Health, Parks & Recreation, or Sheriff’s Office projects or programs. Because many of these are restricted funds, they can’t simply be reallocated to other County needs.

Gilpin County receives support through the Colorado Department of Local Affairs’ (DOLA) Limited Gaming Impact Grant Program, which helps fund public services and infrastructure in response to gaming-related impacts—often through pass-through agreements with local entities directly affected by gaming activities in Black Hawk and Central City.

It’s also important to note that these revenues can be volatile. With known and anticipated state and federal cuts, Gilpin’s intergovernmental funding may shrink significantly — making the County more dependent on other revenue sources.

The Rest of the Pie

When most people think about how Gilpin County is funded, the big categories come to mind first—property taxes, gaming revenue, and state or federal grants. But there are also smaller sources of income that together make a real impact on the County’s ability to provide services.

Here’s a look at the “rest of the pie”:

- Licenses & Permits (1%)

These include building and septic permits, liquor licenses, and concealed handgun permits. While relatively small in the overall budget, these are transactions many residents interact with directly. - Charges for Services (8%)

This category covers fees for specific services, such as transfer station fees, Clerk & Recorder fees, Court fines, planning and zoning fees, and recreation programs. - Interest Income (3%)

Like any household or business, the County earns interest on its investments. These earnings are reinvested into County operations. - Miscellaneous (1%)

A mix of smaller, one-time, or hard-to-categorize revenues, typically things like insurance claims and sale of assets.

Together, these smaller pieces make up about 13% of the County’s total revenue. Each dollar helps cover the cost of programs and services that residents rely on every day.

| 203 Eureka Street Phone: 303-582-5214 |

|

Gilpin County is committed to providing equitable access to our services to all community members. Our ongoing accessibility effort works toward being in line with the Web Content Accessibility Guidelines (WCAG) version 2.1, level AA criteria as published by the Worldwide Web Consortium. These guidelines not only help make technology accessible to users with sensory, cognitive, and mobility disabilities, but ultimately to all users, regardless of ability. Read more or submit a request for accommodation. |